michigan sales tax exemption rules

Focus is on manufacturing operations and not retail. The University of Michigan as an instrumentality of the State of Michigan generally is exempt from payment of Michigan sales and use tax on purchases of tangible property and rentals.

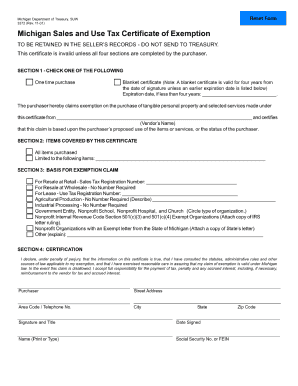

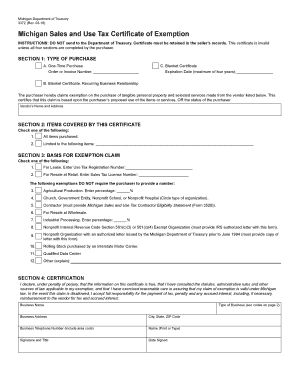

This exemption claim should be completed by the purchaser provided to the seller.

. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the states sales and use tax. Use tax is a companion tax to sales tax.

This page discusses various sales tax exemptions in Michigan. This RAB addresses exemption. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic.

The bulletin replaced RAB 96-6 for all periods on or after June 29 2000. Streamlined Sales and Use Tax Project. Michigan Sales and Use Tax Contractor Eligibility Statement.

Michigan Department of Treasury 3372 Rev. Michigan Department of Treasury 3372 Rev. Michigan Sales Tax Exemptions.

Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state. Many kinds of transactions are exempt from the sales tax such as sales to nonprofit organizations churches schools farmers and industrial processors. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from.

Businesses who sell tangible personal property in addition to providing labor or a service are required to obtain a sales tax license. Michigan manufacturers can easily purchase exempt manufacturing items by supplying their vendors with Michigan Sales and Use Tax Certificate of Exemption Form. The Michigan General Sales Tax Act took effect June 28 1933.

State sales tax research already completed. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. Thursday June 10 2021.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. Notice of New Sales Tax Requirements for Out-of-State Sellers. Sales Tax Return for Special Events.

Sales for resale government purchases and isolated sales were exemptions originally included in the Act. Michigan Sales and Use Tax Certificate of Exemption. Purchasing the Exempt and Taxable reference book has the following benefits such as.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. Michigan has a statewide sales tax rate of 6 which has been in place since 1933. Bulletin 2002-15 RAB 02-15 titled Sales and Use Tax Exemptions and Requirements.

An exemption from sales. The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

7-05 Michigan Sales and Use Tax Certificate of Exemption TO BE RETAINED IN THE SELLERS RECORDS - DO NOT SEND TO TREASURY. Complete the Type of Business Section. Any property which goes with the customer in.

What is Exempt From Sales Tax in Michigan.

Business Guide To Sales Tax In Michigan

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Michigan Sales Tax Small Business Guide Truic

Michigan Sales Tax Handbook 2022

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Sales Tax By State Is Saas Taxable Taxjar

Revenue Administrative Bulletin 1995 3 State Of Michigan

Irs Form 3372 Fill Online Printable Fillable Blank Pdffiller

Resale Certificate Michigan Form Fill Out And Sign Printable Pdf Template Signnow

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Michigan Sales Tax Exemptions Agile Consulting Group

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate